Assessing Hospital Financial Viability in a Period of Economic Disruption

By Adam Davis, Vice President, Juniper Advisory

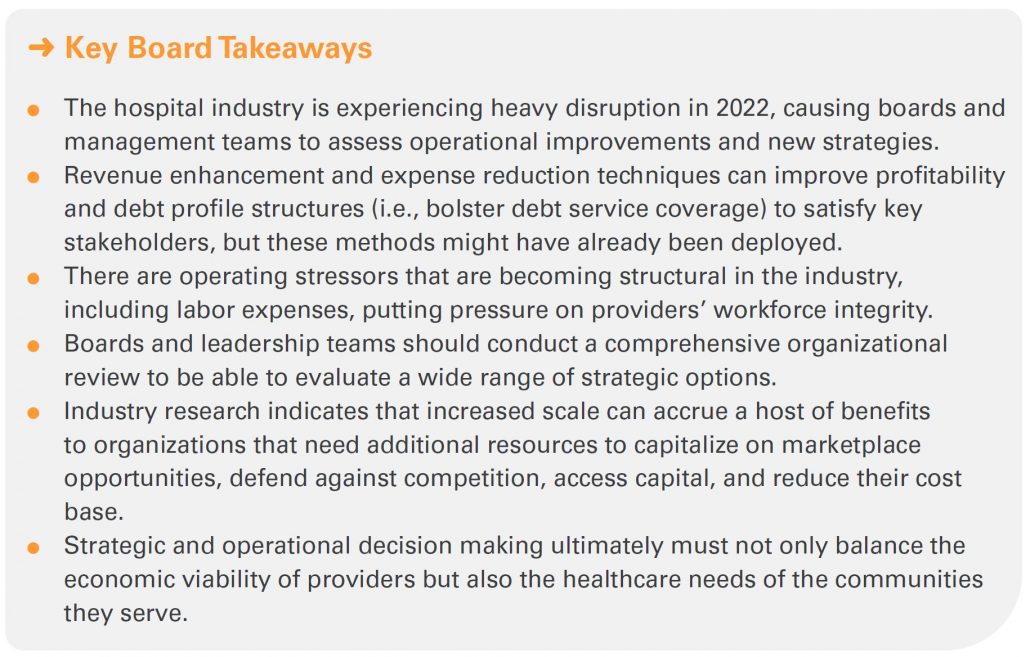

Operating environments for hospitals and health systems are vastly different when comparing 2021 to 2022. The enduring impacts of the COVID-19 pandemic have caused operational disruptions that have severely strained the U.S. healthcare system and outlasted roughly two years’ worth of government stimulus. The stark difference in just one year brings to the forefront questions surrounding how providers, with informed guidance from their boards and management teams, can adapt with focused operational and strategic priorities, and perhaps pursue novel partnerships.

The State of the Industry

After the pandemic began in early 2020, healthcare operators entered a period of uncertainty and financial distress as state and local governments mandated the deferral of elective procedures and shut down key sectors of the economy. However, hospitals and health systems rebounded nicely in 2021 as the mass production and rollout of vaccines seemed to signal the start of a return to normalcy.

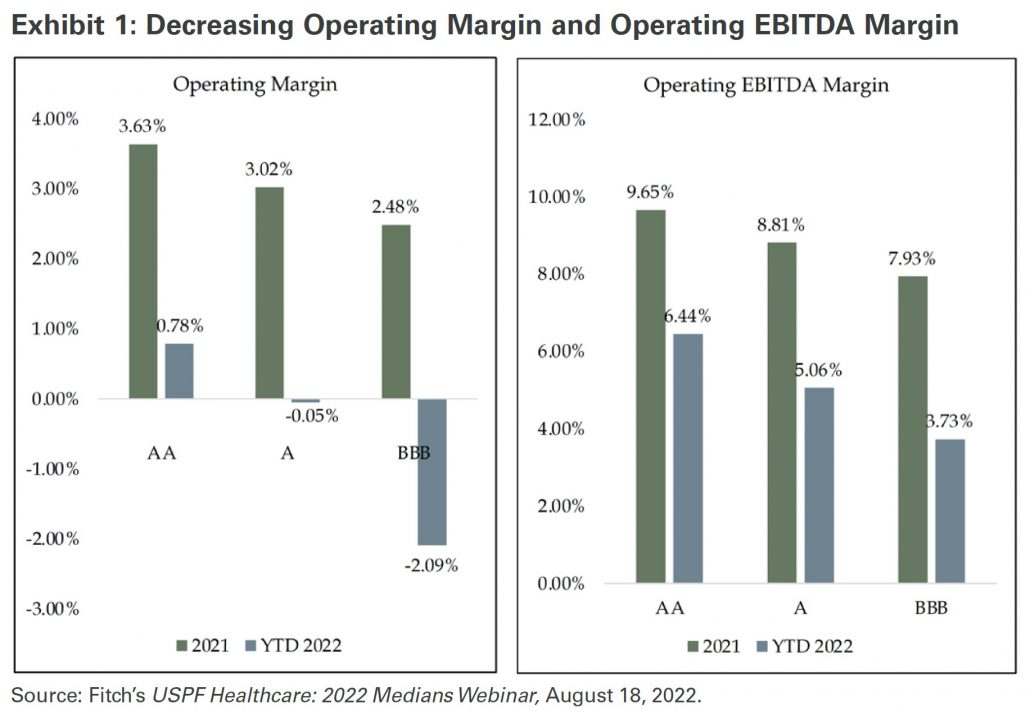

The recovery in 2021 appeared to put the worst of the pandemic in the rearview, but subsequent COVID-19 variants, including Delta and Omicron, resulted in new waves of cases. The rise in caseloads created a protracted strain on revenues and contributed to enduring escalated demand for nursing staff and contract labor. The wide swath of operating challenges in 2022 is not only stressing hospitals’ profitability but also testing the resiliency of their balance sheets. Economic policy changes have also impacted the hospital sector; federal relief has dried up and, after over a decade of near-zero interest rates, the Federal Reserve has raised them, increasing borrowing costs.

Exhibit 1 demonstrates profitability deterioration for both operating margin and operating EBITDA margin between 2021 and year-to-date 2022. The percentage decreases range from roughly 280 to 450 basis points across each of the broad rating classifications of AA, A, and BBB.

Considerations for Boards of Directors

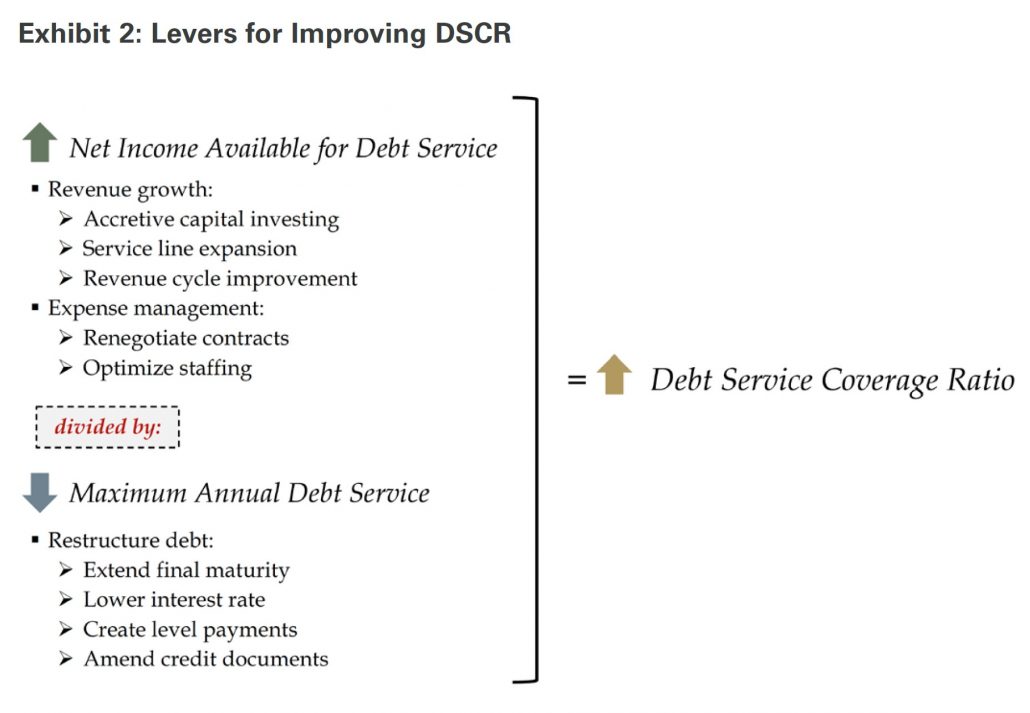

It will be important for hospital and health system boards and management to assess a range of options when guiding the organization through periods of uncertainty. Although portfolio returns were robust in 2021 and years prior, they have, in many cases, flipped from positive to negative so far in 2022. Weaker operations combined with dilutive investment earnings impair providers’ debt service coverage ratio (DSCR), a closely watched performance benchmark by creditors. While this metric might appear to be simplistic (net income available for debt service ÷ maximum annual debt service), there is significant complexity involved when trying to improve either side of the ratio. There are a variety of “levers” available to health systems and hospitals that can improve DSCR related to both the income statement (affecting the numerator) and balance sheet (affecting the denominator) demonstrated in Exhibit 2.

While boards should consider the different options to improve DSCR listed in Exhibit 2, many providers have already exhausted the most obvious alternatives. For example, debt restructuring tactics were deployed when borrowing costs were at historic lows prior to 2022. Further, near-term capital spending plans might be challenged due to supply chain disruption and ongoing volatility in investment portfolios. Therefore, formulating alternative strategies, like developing strategic partnerships, offer operators new options as they strive to deliver quality care, sustain their workforces, and remain robust contributors to their communities.

Boards should thus conduct a holistic organizational review by analyzing both the health system or hospital’s current financial situation and viability going forward. In addition, understanding local and regional market dynamics, particularly competitive pressures, will help illuminate the strategic needs of the organization, and clarify how it can continue to thrive.

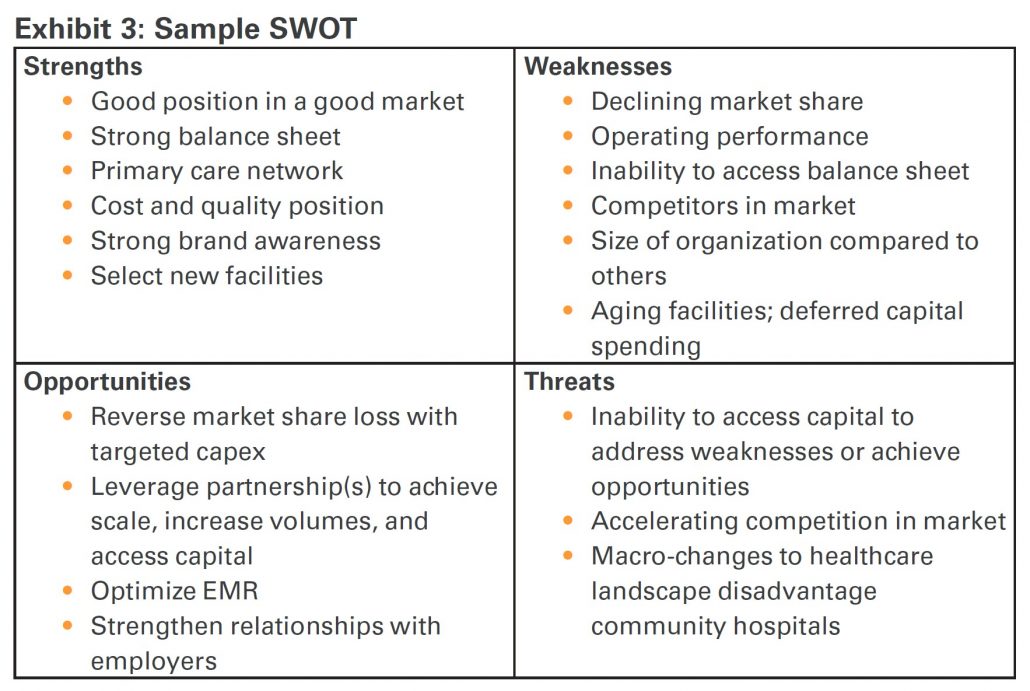

Juniper will often recommend (among other approaches) an analysis of strengths, weaknesses, opportunities, and threats (SWOT) to help guide boards and management teams in their organizational review. Exhibit 3 provides a high-level grid of a sample SWOT. This is one way to jumpstart more tailored strategic discussions between board members, management teams, and other various stakeholders.

Whether a SWOT or other method of formulating a strategy is contemplated, the goal is for boards to construct a list of key objectives for the organization, which helps inform whether they have exhausted the operational levers noted earlier, or should otherwise consider a partnership. Regardless of the path selected, the best course of action must not only maximize the benefit to the health system or hospital, but also the communities it serves. If a partnership process is preferred by the board, they would have a variety of transaction options available to them, where some may be more desirable depending on the unique needs of the organization.

Looking Ahead

Innovation and revamped operational and strategic priorities, perhaps focused on new partnerships or affiliations, will be required to remain viable in the near-term. Increased scale is becoming a stronger consideration for boards and senior leaders, as providers work to combat headwinds, continue to thrive as an organization, and service the community with quality care. Our research suggests that larger revenue bases correspond with higher credit ratings, and therefore lower borrowing costs, which is consistent between the big three rating agencies (Moody’s, S&P, and Fitch). Scale also allows systems to reach preferred agreements with payers and de-risk balance sheets through debt profile diversification. In addition, consolidated resources could mitigate balance sheet deterioration if cash flow is weak, allowing providers to execute strategic capital needs and remain competitive.

Operating pressures show no sign of waning for the remainder of 2022 and will likely continue at least through 2023. Inflation is still a prevalent issue in the economy and if it does not decline soon, the Federal Reserve may continue to raise interest rates, thereby further increasing borrowing costs and creating more volatility in equity markets. As a recent Wall Street Journal article noted, hospitals must “permanently reset” their pay expectations for nursing as the supply-demand mismatch for RNs becomes a structural component of the sector, meaning elevated labor expenses are here to stay.1

Ultimately, boards need to carefully consider a variety of strategic options as they steer the decision making and financial planning for hospitals and health systems. If leadership teams have exhausted most or all of their operational and capital improvement plans, it might be appropriate to consider partnerships that would result in increased scale and better position the organization to meet its objectives and needs of its communities.

The Governance Institute thanks Adam Davis, Vice President, Juniper Advisory, for contributing this article. He can be reached at adavis@juniperadvisory.com.

Click Image for Article PDF