Health Systems’ Financials Look Very Different in 2022

By Adam Davis, Vice President, Juniper Advisory

Operating environments for hospitals and health systems in the US are vastly different when comparing 2021 to year-to-date 2022. The enduring impacts of the COVID-19 pandemic have caused operational disruptions that have severely strained the US healthcare system and outlasted roughly two years’ worth of government stimulus funding. The stark difference in just one year brings to the forefront questions surrounding how providers can adapt through new strategic priorities, and perhaps novel partnerships, but also warrants revisiting the efficacy of industry median metrics that advisors, operators, and investors have come to rely upon for many years.

Where Were We Last Year?

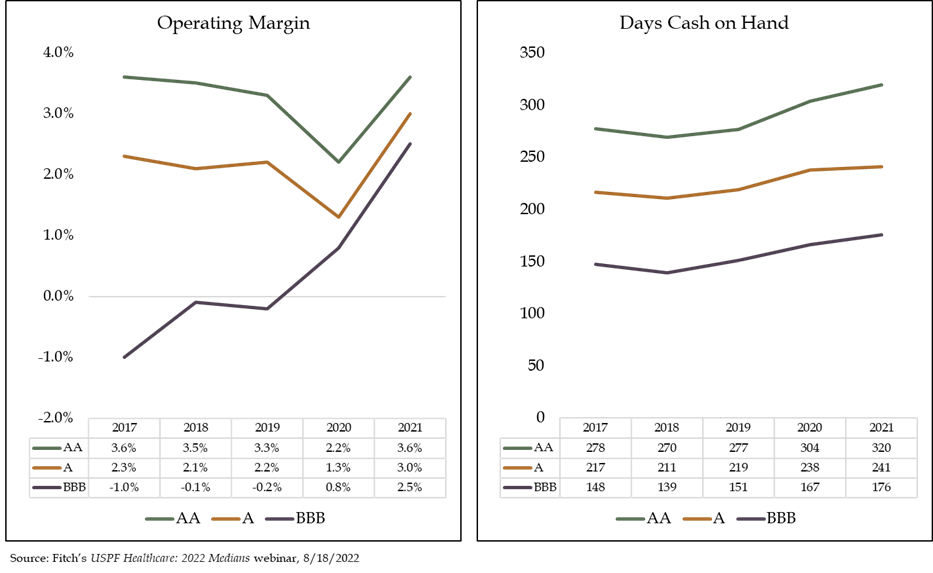

After the pandemic began in early 2020, healthcare operators entered a period of uncertainty and financial distress as state and local governments mandated the deferral of elective procedures and shut down key sectors of the economy. However, hospitals and health systems rebounded nicely in 2021 as the mass production and rollout of vaccines seemed to signal the start of a return to normalcy. Despite a fragmented recovery of providers across the US, patient volumes were generally reaching levels close to pre-pandemic numbers and, in some cases, exceeding them. In addition, the low interest rate environment coupled with the seemingly unending rally in equity markets allowed providers to not only borrow cheaply to fund capital improvements and growth initiatives, but also generate healthy investment returns that cushioned cash flow generation. Residual pandemic-related stimulus funds further boosted profitability as management teams simultaneously implemented cost-saving measures and revenue cycle enhancements. As a result, key rating agency median metrics, such as operating margin and days cash on hand showed good improvement between 2020 and 2021 as demonstrated by the charts below:

Where Are We Now?

The recovery in 2021 appeared to put the worst of the pandemic in the rearview, but subsequent COVID-19 variants, including Delta and Omicron, resulted in new waves of cases. The rise in caseloads created a protracted strain on revenues and contributed to enduring escalated demand for nursing staff and contract labor. The multitude of operating challenges in 2022 is not only stressing hospitals’ profitability but also testing the resiliency of their balance sheets. Economic policy changes have also impacted the hospital sector; federal relief has dried up and, after over a decade of near-zero interest rates, the Federal Reserve has raised them, thereby increasing borrowing costs. While portfolio returns were robust in 2021, they have become tenuous in 2022 and, for many providers, those returns have flipped from positive to negative year-to-date. Weaker operations combined with dilutive investment earnings impair hospitals’ debt service coverage ratio (DSCR), a closely watched performance benchmark by industry lenders, financial advisors, and bondholders. As a result, Fitch Ratings signaled concern over DSCR covenant violations which might not only occur in 2022, but also well into 2023.

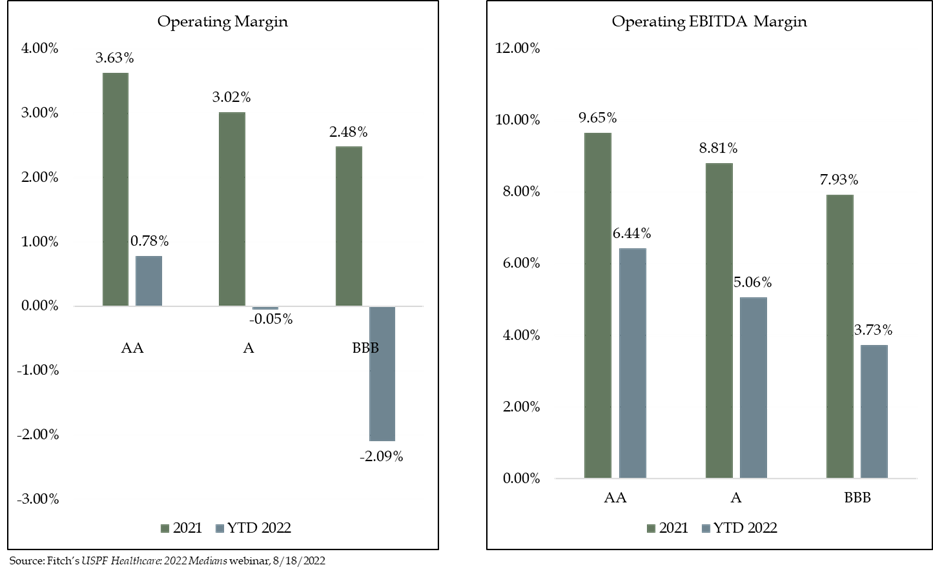

The graphs below further demonstrate profitability deterioration for both operating margin and operating EBITDA margin between 2021 and YTD 2022. The percentage decreases range from roughly 280 to 450 bps across each of the broad rating classifications of AA, A and BBB.

Healthcare industry experts often use rating agency median reports to benchmark hospitals’ and health systems’ overall financial performance. While the medians are comprehensive and informative, they do not capture the most updated publicly available data, and only aggregate audited financial reports over the most recent full fiscal year for its rated portfolio. The latest Fitch medians report, for example, captures 2021 financials but does not incorporate any financial data reported for 2022. In more normal circumstances, this lagging factor would not materially impact the validity of the medians, but because hospitals’ financial positions in 2021 were so different than they are so far in 2022, the most recent medians report is arguably irrelevant in informing us about current industry dynamics. What’s telling is that Fitch’s Sector Outlook was revised to “Deteriorating” right before the release of their medians report last week, which speaks to their acknowledgement of current operating pressures felt by providers.

Looking Ahead:

Innovation and revamped strategic priorities, perhaps focused on new partnerships or affiliations, will be required to remain viable in the near-term. Increased scale is becoming a stronger consideration for operators, as providers work to combat headwinds, continue to thrive as an organization, and service the community with quality care. During Fitch Ratings’ USPF Healthcare: 2022 Medians webinar on August 18, 2022, they indicated that a health system’s size could help blunt operating losses and minimize fixed costs. In fact, our research suggests that larger revenue bases correspond with higher ratings, which is consistent between the big three rating agencies (Moody’s, S&P and Fitch). Scale also allows systems to reach preferred agreements with payors, lower the cost of borrowing, and de-risk balance sheets through debt profile diversification. In addition, consolidated resources could mitigate balance sheet deterioration if cash flow is weak, allowing providers to execute strategic capital needs and remain competitive.

As Fitch also noted in its webinar, operating pressures show no sign of waning for the remainder of 2022 and will likely continue for at least another full year in 2023. Inflation is still a prevalent issue in the economy and if it does not decline soon, the Federal Reserve may continue to raise interest rates, thereby increasing borrowing costs and creating more volatility in equity markets. As David Wainer’s July 27th piece in the Wall Street Journal noted, hospitals must “permanently reset” their pay expectations for nursing as the supply-demand mismatch for RNs becomes a structural component of the sector, meaning elevated labor expenses are here to stay.

Providers can only cut expenses so much through tactics like renegotiating purchasing contracts, optimizing staffing structures or refinancing debt. Many of these operational improvement “levers” have already been pulled to right size financial performance, so formulating new strategies will become increasingly important for health systems as they strive to deliver quality care and sustain the integrity of their workforces.

For more information about Juniper’s work in healthcare, please contact Adam Davis, Vice President, 312-506-3003 or [email protected].

Click image for PDF of article