Special Report: Healthcare M&A Predictions for 2024

Read what trends our team believes will shape the healthcare M&A market and hospital industry next year. They share thoughts on performance, headwinds, trends in business combinations, and issues across the macro health system environment. Several clear themes emerged. Welcome to 2024.

More distressed acquisitions due to persistent operating pressures

Adam Davis

Expense challenges will continue to disrupt the hospital sector, leading to more distressed transactions in 2024. Persistent operating pressures will also foster an environment of “haves” and “have-nots” where larger, more well-capitalized health systems will have greater financial security, whereas smaller ones with lighter balance sheets may struggle to provide quality healthcare. Management teams and boards must closely monitor their strategic and operational needs to prevent doing a transaction out of desperation. However, for some companies, there may not be many viable options, as the severity of operating stress in recent years has already exhausted their turnaround resources, making 2024 pivotal.

Increasing involvement by academic medical centers in mergers and partnerships

Brent McDonald

Academic medical centers are active participants in the current wave of mergers, affiliations and partnerships in order to sustain their long-term mission. AMCs face the same headwinds as the rest of the industry but also must navigate additional complexities in meeting their tripartite missions (clinical, research and training). Activity in the last 12+ months is strong, including transactions announced involving the University of Iowa, the University of Kansas, LCMC Health, Yale New Haven, Henry Ford, and the University of Michigan. The partnership and merger activity is due in part to the continued recognition by AMCs (and university affiliated health systems) that serious threats are coming from growing regional and national systems, new PE-backed ambulatory focused companies and the steady march of technology that now allows formerly complex procedures to be performed in non-AMC (or even ambulatory) settings. Further, there is an awareness that the size of the clinical enterprise and number of lives or population under influence has a strong correlation on the ability to have a sustainable academic / research mission. In addition to stabilizing its regional referral base, other advantages of growing an AMCs hospital and delivery network through affiliations include: stronger geographic coverage, better network for VBC and MCO relevancy, enhanced primary care base and increased number of convenient care access sites. The AMCs do have certain typical advantages when discussing mergers and partnerships with other hospital systems, including strong brand awareness, quality outcomes, ability to recruit staff, nurses and higher end specialties, and strong investments in technology and best-in-class EHRs that benefit care delivery. These advantages play very well with NFP hospital boards and generally overcome any legacy views of the AMC being bureaucratic or non-responsive.

Increased average revenue base for targets

Casey Webb

The size of hospital transactions will continue to grow in 2024. In the past, most partnerships included large systems acquiring single site, small operators, but as the benefits of scale have become more evident, larger organizations (in addition to smaller ones) with strong capabilities have sought aspirational partnerships to advance their goals and objectives. This trend shows no sign of slowing down and will likely continue based on current market activity and recent transaction announcements. Just like smaller companies, large and mid-sized operators want to continue to thrive and fulfill their missions, and partnership exploration has increasingly become a viable strategic option.

Disruptors and new entrants chipping away at margins

Chris Benson

Beyond the familiar concerns of inflation, volatile revenue streams and tight cash flows lies a simmering long-term threat that commands executive and board focus: the rise of disruptive healthcare players. Nation health expenditures of $4.5 trillion attract investment. Well-capitalized and tech-savvy entrants will persistently evolve and chip away at traditional healthcare delivery models and margins. They are not coming after the underinsured patient seeking care at your Emergency Room at 3AM, nor are they saddled with legacy cost structures, community commitments and charitable missions. Organizations awaiting volumes to return or for patients to be satisfied with existing modes of accessing providers are going to continue to experience slow declines. Partnerships and organizational investments that improve quality while reducing cost are always a winning bet. Existing assets must be candidly assessed with the same lens. Patient focused innovation, even if it is disruptive, is a positive force. Scaled providers with aligned and integrated clinical teams have the best shot at thriving for their patients.

Longer capital commitment periods

Farley Reardon

The capital or investment commitment is often a key objective to support the decision to sell or partner but often focuses on the short-term, deferred needs of the hospital or health system. The continued trend toward longer capital commitment terms (more than 10 years) creates value for both sides of a relationship by creating certainty of a long-term investment commitment for the Seller and its community, while allowing for flexibility for the Buyer to make investments with a longer vision to meet ever changing advancements and demands. With the improvements in technology, changes in patient demand and reimbursements, and limitations of human capital (increasing demand for providers to technicians to clerical staff), a longer horizon for capital investment, even if lower based on the comparable annual capital investments, will create more value for the community to have certainty of long-term investment and to provide flexibility for the type of investments in developing technologies, services and care sites, and committed resources for investment in the system’s clinical and non-clinical team members.

More cross-region consolidation

Jordan Shields

Multi-region transactions like Advocate-Atrium, Kaiser/Risant-Geisinger, Intermountain-SCL and others will continue in 2024. For example, as Advocate and Atrium stated in their merger communications, the Midwest and the MidAtlantic are now adjacent healthcare markets. While the scale benefits of hospital transactions can include in-market clinical and referral synergies, those tend to be secondary to the market-independent structural synergies of best practices, corporate finance, population health infrastructure, purchasing and other gains. To fully realize those benefits, organizations typically need to undergo structural and ownership change, indicating that loose affiliations and other “dip-the-toe-in” partnerships are likely to cool off in 2024.

Nonprofit systems hold the advantage in today’s M&A market

Rex Burgdorfer

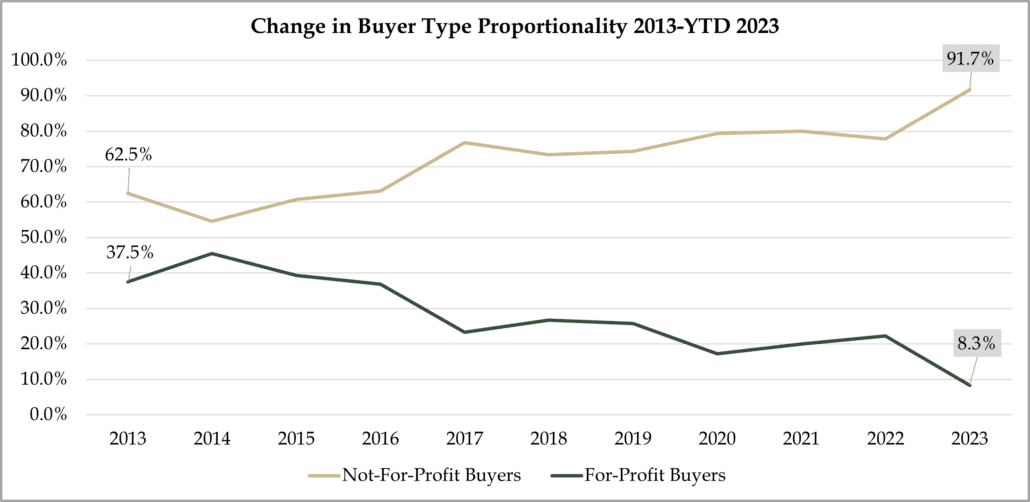

A clear trend in 2023 that we expect will continue in 2024 is the strong advantage held by regionally prominent non-profit health systems in the acquisition market. Their share of transactions has grown materially over the last decade – – from ~70% of the total to now over ~90%.

The difference between the non-profit and the for-profit sectors has widened since the passage of the Affordable Care Act. Non-profits have a stronger perceived reputation of medical quality and safety. They benefit from tax-exemption (sales and property), programs like 340B drug pricing, typically have greater regional density for reimbursement strategies, and lower administrative overhead.

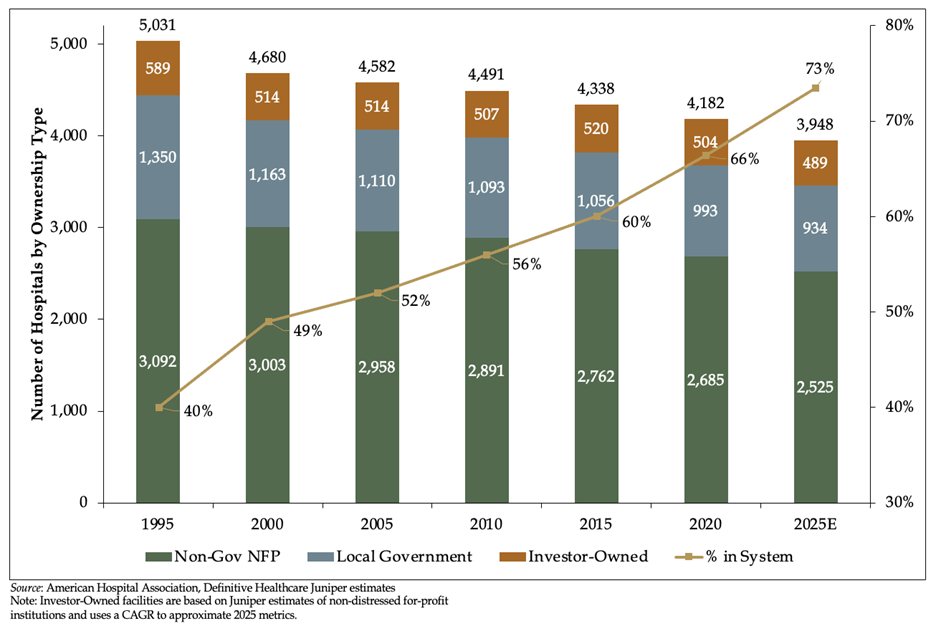

Local governments participating in change in an outsized way

Hospitals sponsored by local governments are participating in change in an outsized way. In 1995 there were 5,031 total hospitals in the US, of which 1,350 (27%) were controlled by political subdivisions (cities, counties, districts, etc.). Today there are 4,200 hospitals with 960 (23%) controlled by local government. Of Juniper’s current assignments, roughly one-third involve public owners – so they are participating in change in a higher proportion than their peers. There is a general consensus that political subdivisions are not likely positioned to be on the cutting edge of technological advances. Harnessing the power of integrated Electronic Health Records like EPIC are not typically practical financially or operationally for independent organizations, which most public hospitals are.

For more information about Juniper’s work in healthcare, please contact us at 312-506-3000 or [email protected].