Cross-Market Health System Consolidation in a Challenged Industry

By Adam Davis, Vice President, and Rex Burgdorfer, Partner, Juniper Advisory

As health systems continue to tackle the ongoing pressures placed on the healthcare delivery system driven by consumerism, value-based care, payer reimbursement issues, labor shortages, and a myriad of other challenges, senior leadership and boards are engaging in more strategic discussions and creative pathways to partnership models. One of these solutions is to partner with organizations in geographically disparate areas of the U.S. This partnership strategy has become a growing trend in the industry.

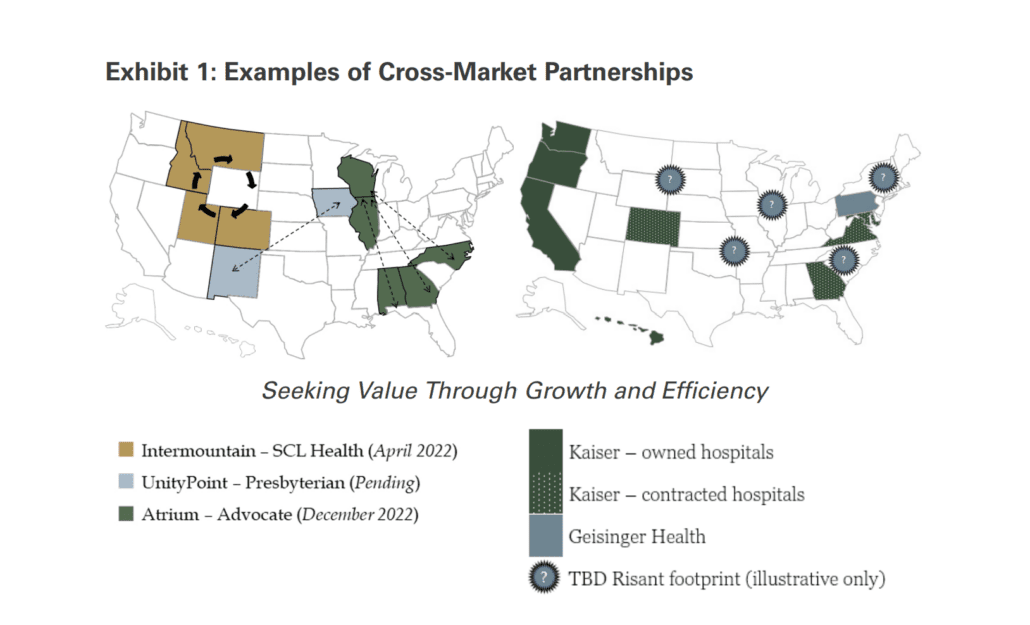

Research shows that 55 percent of the 1,500 hospitals targeted for a merger or acquisition between 2010 and 2019 were in a separate geographic market than the acquirer. Cross-market mergers have continued as several mergers between health systems in different states closed in the last year, with other “megamergers” such as the recently announced Kaiser Permanente’s acquisition of Geisinger. This cross-market merger and acquisition activity suggests that some health systems are seeking to move beyond traditional horizontal consolidations as part of their growth strategies.

Cross-market activity is an indicator that hospitals and health systems are looking more strategically at partnerships that position them for the future. Although operations are an important factor, it appears the drivers behind cross-market mergers are more about expanding and building on capabilities to provide care and less about economic difficulties. A few notable examples that have come to fruition over the last year include Intermountain’s merger with SCL Health, Advocate Health’s merger with Atrium Health, UnityPoint and Presbyterian’s recent partnership announcement, and Kaiser Permanente’s acquisition of Geisinger through a new 501(c)3 called Risant Health. Exhibit 1 illustrates how these transactions are crossing geographical markets.

Drivers of Cross-Market Transactions

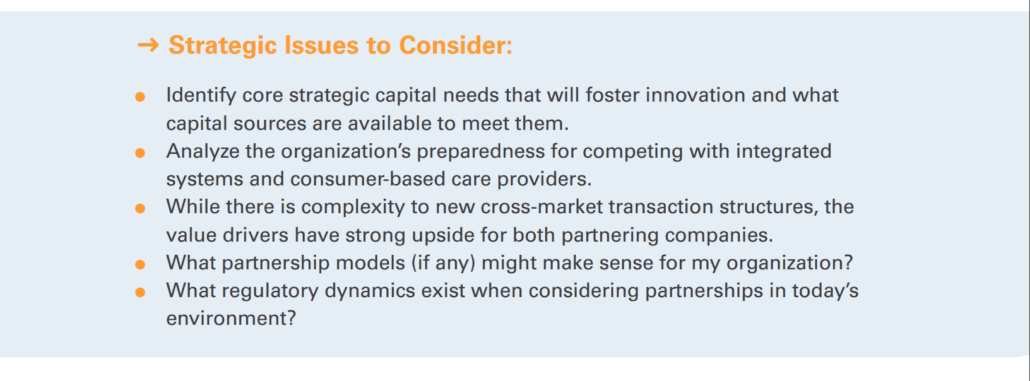

To gain further insights into the value drivers behind cross-market transactions, we interviewed a few health system executives. Consistently we heard that the ability to extend their scale and build on capabilities ranked among the highest in terms of value drivers. Additionally, enhancing access and quality of care to communities while realizing efficiencies through greater scale were key value drivers.

One Chief Strategy Officer used the term “economies of capabilities vs. economies of scale” when referring to the drivers behind a recent cross-market transaction. This was echoed by other hospital executives who stated that when looking at potential partners, outside of alignment to their mission, they are looking for ways to bring their scale and extend and build on platform capabilities.

In addition to building on capabilities, some executives cited examples where cross-market transactions did yield synergies. Many of the difficulties hospitals and health systems face today are lingering consequences from the pandemic. However, it also helped normalize remote work, making cross-border partnerships more feasible. Health systems now have the flexibility to assess labor synergies outside of their local markets for certain corporate functions like finance, IT, or human resources. While these are important components of the overall health system’s enterprise, employees in these departments may not need to be located at specific physical locations to conduct their work, presenting health systems with an opportunity to both consolidate real estate holdings and think more broadly about where to locate people.

Economies of scale are also enhanced if the partnering organizations have unique and/or complementary core competencies. Cross-regional partnerships open doors for health systems to expand their search for potential suitors and consider a more comprehensive range of organizations with distinctive capabilities. For example, the Presbyterian Health-UnityPoint relationship would bring together Presbyterian’s $4 billion health plan and UnityPoint’s proven experience managing a multi-state health system across 31 hospitals. Kaiser’s focus on payer integration, leading technology platforms, and research, coupled with Geisinger’s health plan success and progressive, aspirational vision in Pennsylvania could set up Risant Health for future success.

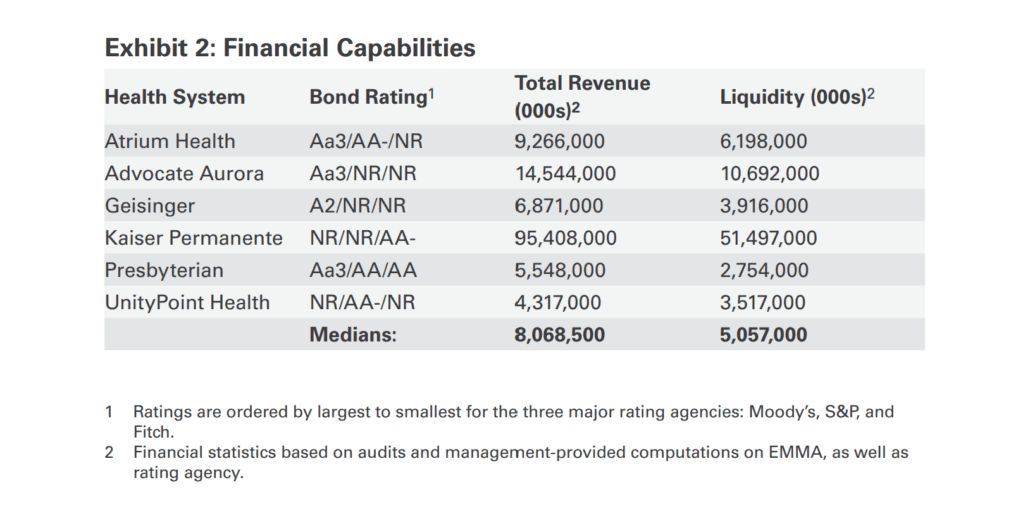

Financial wherewithal and stability are attractive characteristics when looking to form these arrangements to foster growth, achieve scale, and further the organization’s mission. A common thread between cross-regional transactions is that the partners have strong credit ratings, large revenue bases, sound balance sheets, and robust debt capacity. This is particularly necessary in this current operating environment where financial strain can heighten transaction risk. Exhibit 2 provides a summary of some key metrics

demonstrating each system’s financial capabilities. Each entity is a highly rated (at least in the “A” category) multi-billion-dollar enterprise with ample cash and investments.

demonstrating each system’s financial capabilities. Each entity is a highly rated (at least in the “A” category) multi-billion-dollar enterprise with ample cash and investments.

Regulatory Considerations

Under the current administration, the FTC has taken a more aggressive stance toward health system transactions. In fact, in a 2022 article, KFF Health News quoted Mark Seidman, an Assistant Director in the FTC’s Bureau of Competition, emphasizing the FTC’s ongoing position on healthcare transactions: “We are feeling invigorated and looking to fulfill the executive order’s call to be aggressive on antitrust enforcement.”[1] Thus, health system transactions are in the spotlight for anti-competitive scrutiny, but this has been weighted more toward traditional horizontal mergers in the same geography, whereas cross-regional partnerships may not trigger the same level of scrutiny. According to McDermott, Will & Emery, cross-regional transactions have not been formally challenged by the FTC yet, but these types of mergers could present competitive effects if there are common payer and employer customers and are they are competing to be in the same payer and

employer networks.[2] However, it is too early to determine how the FTC will handle these transactions, but it has become more aware of them. In fact, the FTC recently announced the addition of cross-market theory questions to second requests, which signals their newfound concern for these types of mergers.

employer networks.[2] However, it is too early to determine how the FTC will handle these transactions, but it has become more aware of them. In fact, the FTC recently announced the addition of cross-market theory questions to second requests, which signals their newfound concern for these types of mergers.

Novel Structures, Familiar Challenges

Through various conversations with health system executives about cross-market transactions, cultural integration was cited as a major challenge for closing transactions and post-closing integration. This issue is not novel; culture fit has been a focal point not just for cross-regional partnerships, but for traditional in-market mergers as well, such as Sentara and Cone Health’s called-off merger in 2021. For this particular deal, the leadership teams at each organization revealed that there were general cultural mismatches that surfaced late in the due diligence process, ultimately making the deal fall apart.[3]

Local markets are complicated enough, but attempting to merge and integrate distinct organizational cultures in varied geographies presents a new layer of complexity for health system partnerships. Recently announced and completed cross-regional transactions are in nascent stages of closing or post-closing integration, so time will tell how both organizationally and regionally related cultural differences might impact the success of these new transaction types. However, if past experience is any indication of what might make or break these partnerships, cultural differences could be significant roadblocks to getting a deal done.

Governance is also a major consideration when trying to successfully close transactions and/or integrate health systems. This is especially true for cross-regional partnerships that require combining two large enterprises with multi-tiered organizational structures. Unlike smaller, tuck-in acquisitions in local service areas, cross-regional ones require fundamental changes to the overall operating model, which necessitates board-level restructuring and sometimes difficult conversations around the future configuration of the combined workforce. Management teams and boards from both organizations thus face uncertainty and any misalignment on how

the partnership will reconfigure the organizational chart can cause a rift in trying to close and successfully integrate.

Capital investment management can also be a crucial and complex topic as both systems must coordinate and agree on how the capital allocation process will work pre- and post-merger. As noted earlier, cross-regional partnerships involve systems with exceptional access to capital with strong cash positions, so both partners have the means to make necessary routine and strategic investments across all markets. While combining capital resources is an advantage in these transactions, it brings a level of complexity that more traditional partnerships do not face, which includes deciding which geographic markets should be prioritized (if at all). For example, Atrium operates in states like North Carolina, which experienced strong population and economic growth over the last several years. On the other hand, Advocate Aurora is based in the Midwest, which has faced recent population outflows in states like Illinois. As the integration process moves forward, both organizations will need to carefully coordinate how proceeds flow throughout the integrated network and ensure resources do not skew toward some areas at the expense of other geographies. Although enterprise growth is crucial to the success of the relationship, management teams and boards will want to maximize the financial upside of their capital deployments but ensure they provide quality care in their service areas.

Closing Thoughts

Cross-regional transactions are becoming more frequent as the U.S. healthcare operating environment continues to put stress on hospitals. We expect more of these cross-market transactions to surface in the near term as well-capitalized, highly rated organizations seek to grow their enterprises, enhance their value, and further their missions. Over time, transaction developments will inform us whether systems can successfully navigate a range of issues made arguably more complex due to geographic diversification. If they thrive, however, the financial benefits to partnering enterprises could be significant. There will also be new opportunities for reputable institutions to expand their capabilities outside of their local markets, which would not only help the partnering companies succeed, but also support the communities they serve.

The Governance Institute thanks Adam Davis, Vice President, and Rex Burgdorfer, Partner, Juniper Advisory, for this article. They can be reached at adavis@juniperadvisory.com and rburgdorfer@juniperadvisory.com. The authors would like to thank Lisa Ann Mathews, Director, and Brian Morton, Managing Consultant, at Berkeley Research Group for contributing to this article.

Click Image for Article PDF